The Endowment

Related Links

The Role of the Endowment

The University of Chicago’s endowment supports the fundamental mission of the institution—to produce a caliber of teaching and research that regularly leads to advances across the sciences, medicine, law, business, the arts, and humanistic inquiry. The endowment provides a permanent source of income to these endeavors by supplementing the operating budget of the University.

Today, the endowment funds 17 percent of the University’s operating budget, which supports academic programs, student aid, instruction, research, faculty salaries, library acquisitions, and maintenance of campus buildings. Through endowment resources, our community of top students, researchers, and scholars connects through hundreds of programs and partnerships in more than 48 countries. These initiatives strengthen the University’s impact in fostering rigorous inquiry and tackling the world’s most complex issues.

Preserving and growing the endowment ensures continued support for the transformative education and innovative research produced at the University. To this end, the University of Chicago’s endowment is actively invested in a diversified portfolio with long-term growth potential that reliably provides income for current and future generations.

TRIP Investment Strategy

The University’s endowment is largely invested in the Total Return Investment Pool (TRIP), a portfolio broadly diversified across asset classes, geographies, sectors, liquidity terms, and investment instruments. TRIP’s primary objective is to maintain the real purchasing power of the endowment net of inflation and spending. Currently, the endowment spending rate is 5.5 percent.

The investment strategy of TRIP seeks to maximize returns while keeping within the risk and illiquidity tolerances of the University’s financial position. Other important measures of TRIP’s success include performance versus a naïve benchmark, composite benchmark, and institutional peers. The Investment Committee of the Board of Trustees is responsible for approving the risk management guidelines for TRIP and the portfolio’s overall asset allocation.

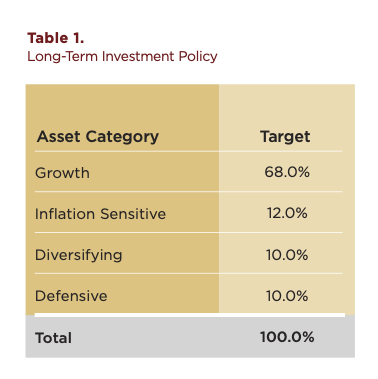

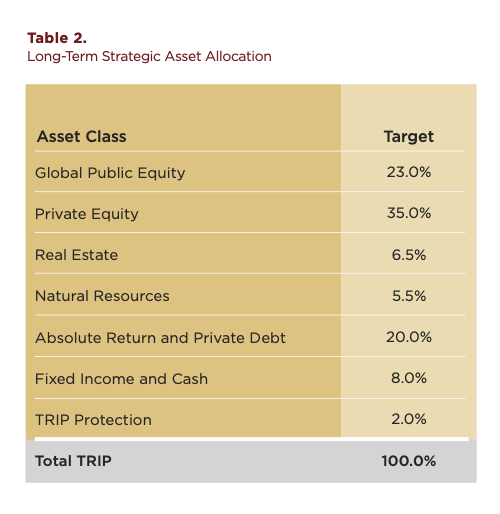

TRIP’s long-term plan maintains strategic allocations to growth, inflation sensitive, diversifying, and defensive assets (see tables 1 and 2). Investments within these categories include global stocks and bonds, real estate, natural resources, private equity, and absolute return strategies. TRIP’s strategic asset allocation targets 50 percent exposure to private investments across these areas, using a dynamic commitment framework to manage investments.

Investment Leadership

The Office of Investments and the Investment Committee of the Board of Trustees provide stewardship of the University’s $14 billion in investment assets, including management of the endowment.

The Office of Investments upholds a high standard of excellence in the institutional investment space and understands the importance of its fiduciary responsibility to the University of Chicago. Driven by core principals of intellectual honesty, collaboration, integrity, and diversity of thought, staff of the Office of Investments concentrate in high-conviction themes and seek a shared mission with every constituent of the endowment, including external asset managers.

Investment Partnerships

For many years, the Office of Investments has partnered with exceptional asset managers who invest the endowed funds of the University. To select and engage investment managers who are experts in the strategies they employ, the Investments staff of the University conduct a rigorous due diligence process. In doing so, the University of Chicago has cultivated long-standing relationships with the most innovative and successful asset managers across industries.

The endowment’s asset managers leverage profound expertise across specialized industries and apply deep market fluency to investment processes that are disciplined and aligned with the University. Beyond demonstrating the ability to generate alpha, the University’s investment managers build unique sourcing engines and establish the potential for long-term growth in concentrated opportunity sets. The Office of Investments also believes that firms that demonstrate a commitment to diversity are more likely to succeed in an increasingly global marketplace. By establishing relationships with firms that have diverse owners and workforces, the Office of Investments broadens TRIP’s exposure to business opportunities that can provide superior investment returns.

Investment Performance

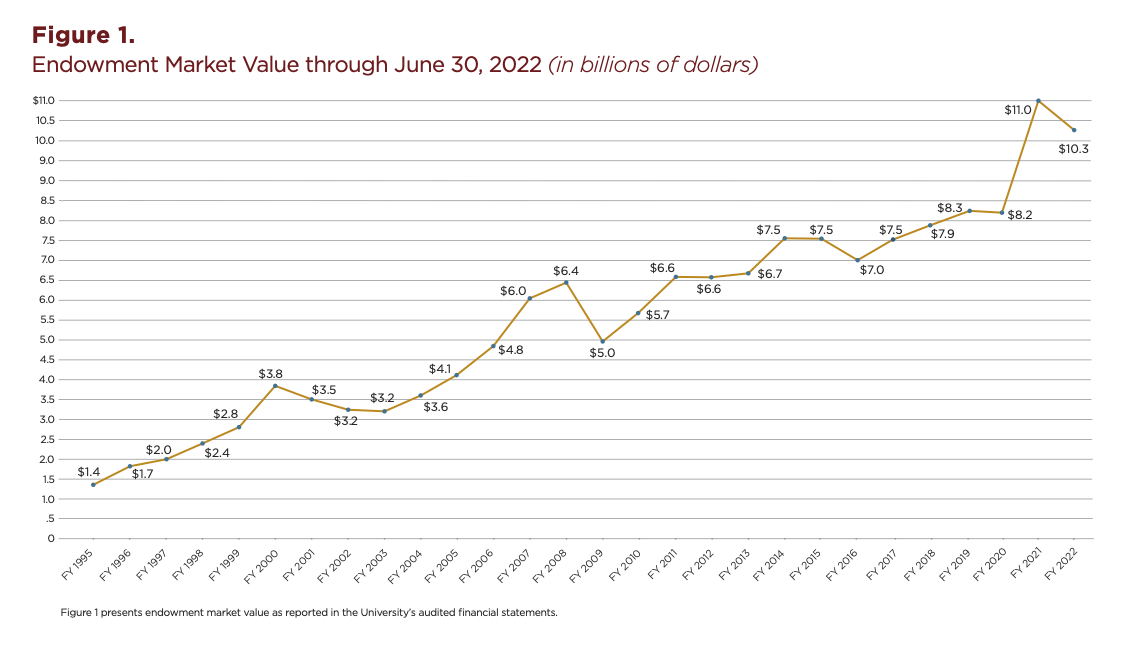

The University of Chicago’s endowment ended fiscal year 2022 at $10.3 billion as of June 30, 2022, with a –8.8 percent return on investments. This figure follows a 37.6 percent annualized return in fiscal year 2021. (See figure 1.)

In the first half of fiscal year 2022, global equity markets generated strong performance for the University’s endowment. The second half of the fiscal year saw considerable declines in global equity and bond markets, marking an unusual point in history where stocks and bonds were in bear markets at the same time. With inflation, rising interest rates, geopolitical concerns, and fears of recession driving steep sell-offs in equity markets, TRIP’s return was pulled into rare negative territory. During this period of volatility, the Office of Investments continued to manage the endowment with a disciplined investment approach.

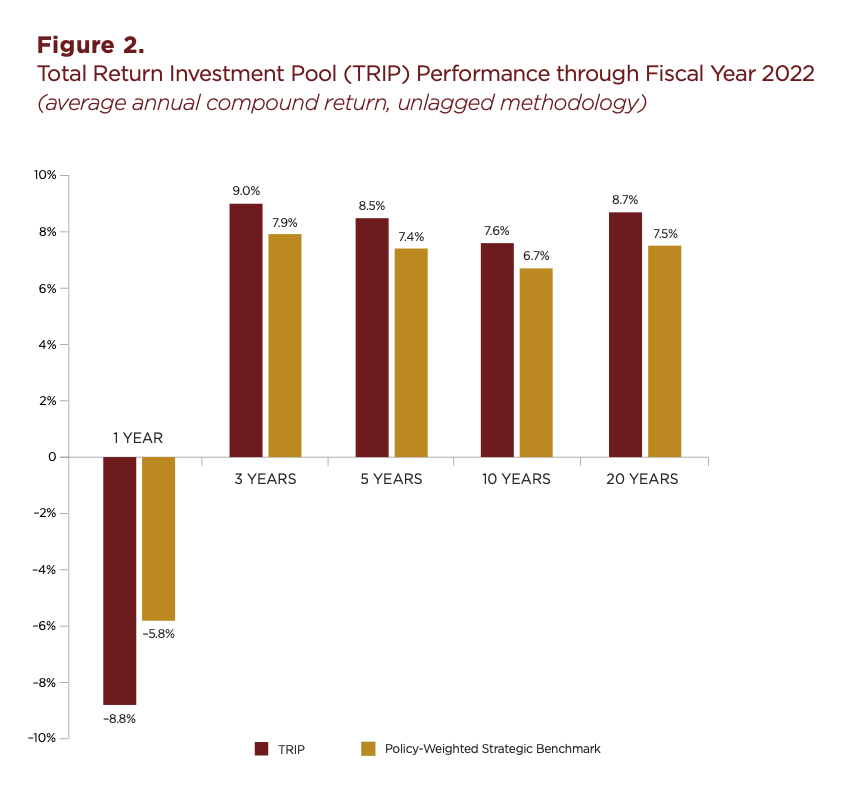

The Office of Investments maintains a long-term focus on the University’s endowment performance. Over 10- and 20-year time horizons, TRIP has generated annualized returns of 7.6 percent and 8.7 percent, respectively, outperforming the University’s naïve and market-based, policy-weighted strategic benchmarks (see figure 2). The annualized 10- and 20-year returns of the naïve benchmark are 6.7 percent and 6.6 percent, respectively, while the strategic benchmark returns are 6.7 percent and 7.5 percent, respectively.